Corporate

From ClaimFlux to intelligent decisioning and enriched data, our Tech & Data Solutions help institutions make smarter, faster financial decisions — boosting efficiency and turning data into strategic advantage.

From ClaimFlux to intelligent decisioning and enriched data, our Tech & Data Solutions help institutions make smarter, faster financial decisions — boosting efficiency and turning data into strategic advantage.

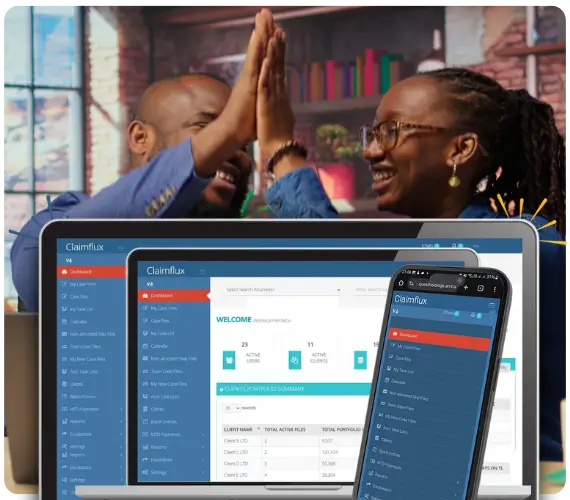

ClaimFlux is a smart, web-based debt recovery platform that helps institutions automate workflows, segment portfolios, and improve recovery rates with real-time insights.

Our call center systems are built to help organizations streamline customer engagement, manage high-volume interactions, and improve agent performance. With real-time dashboards, call tracking, and workflow automation, businesses can enhance service delivery, boost operational efficiency, and maintain a professional customer experience — all in one place.

Our HR and LMS platforms enable businesses to manage their people, processes, and professional development from a single, integrated system. From recruitment and onboarding to performance tracking and e-learning, we help organizations build skilled, compliant, and motivated teams — while reducing administrative overhead.

ClaimFlux is QRS’s intelligent debt recovery platform, developed to help financial institutions streamline collection operations, improve recoveries, and make smarter decisions using real-time data. It transforms how teams manage portfolios — with automation, scorecard-driven segmentation, and transparent workflows all in one platform.

ClaimFlux is ideal for banks, MFIs, lenders, and portfolio managers looking to improve operational efficiency and credit performance at scale.

We help lenders automate collection strategies through customized scorecards, portfolio quality indicators, and collection propensity forecasts. These machine-learning-powered tools drive smarter segmentation, improve efficiency, and reduce recovery guesswork — whether embedded in your system or used standalone.

We design scorecards tailored to your portfolio and customer behavior, helping you assign risk ratings, prioritize collection actions, and improve recovery efficiency. These models use historical repayment data, customer traits, and behavioral signals to predict which accounts are most likely to default — and how to approach them. Scorecards can be embedded in your collection system or used independently.

Get Started NowOur portfolio indicators provide a high-level view of debt health, identifying patterns, risk clusters, and shifts in collection performance. By tracking metrics such as roll rates, vintage delinquency, and payment timelines, institutions can monitor risk exposure and proactively adapt their strategies. These indicators offer clarity for credit managers, analysts, and operational teams.

Get Started NowWe help lenders forecast which accounts are most likely to pay — and when. Using historical data and machine learning, our models analyze behavior trends and repayment history to determine the probability of recovery across segments. This enables smarter agent allocation, better timing of engagement, and more effective collections overall.

Get Started Now

It begins with a simple hello. Whether you're an institution or individual, we listen to your unique challenge and explore how we can help.

We deep-dive into your needs, assess your financial landscape, and design data-backed strategies that are tailored, realistic, and aligned with your goals.

With smart tech, human insight, and transparent processes, we deliver solutions that drive recovery, reduce risk, and create lasting financial impact.